The State of Open Finance in the US: 6 Drivers of Change

What we have formerly known as traditional banking solutions are increasingly becoming a residual consumption choice. Take a look at the future of finance.

There is no such thing as “traditional” financial services anymore. What we have formerly known as traditional banking solutions are increasingly becoming a residual consumption choice, and tends to disappear with the rise of younger generations into the workforce.When we say this, we mean that even the most tenured financial institutions have already adapted to the new reality that is taking place in the financial industry. Part of that reality is Open Finance.

The wide range of opportunities available through Open Finance has contributed to creating new financial products and experiences for customers. On a more macro level, it has enabled the emergence of new payment methods that have profoundly changed our consumption habits.

Since the introduction of Open Finance – still as Open Banking – the financial industry has changed a lot. Now it’s time to examine how Open Finance has changed its course. In this article, we’ll discuss how we arrived at our current context, the state of open finance today, and where we see the market heading in the years to come.

The State Of Open Finance In The US

While it may have started later in the U.S. compared to Europe, it is rapidly becoming a central topic of discussion for the nation’s largest banks. This surge of interest is largely attributed to the forthcoming regulation expected to come into effect in early 2024.

The regulatory landscape in the U.S. is set to evolve with the introduction of new rules by the Consumer Financial Protection Bureau (CFPB) and amendments to the Dodd-Frank Act, particularly Section 1033, which will govern open banking practices.

One of the pivotal changes brought about by these regulations will be the elimination of unsecured screen scraping. Historically, account aggregators and fintech companies have relied on this method to access user financial data. The impending rules will mark a significant shift towards more secure and standardized access mechanisms, making the financial ecosystem safer and more robust.

To adapt to this changing landscape, many financial institutions are now actively committing resources to their open banking initiatives. Banks are forming dedicated teams and organizations responsible for formulating a coherent strategy. The goal is to ensure compliance with the new regulations and to leverage the opportunities that open banking presents.

In the United States, the Financial Data Exchange (FDX) is playing a pivotal role in shaping the open banking ecosystem. FDX, a nonprofit organization, is dedicated to creating a common, interoperable, and royalty-free standard for secure access to user-permissioned financial data. Its FDX API has emerged as the de facto standard for North America, facilitating the seamless and secure exchange of financial data.

Open Finance By The Numbers

The concept of open finance can sometimes seem to be a broad umbrella term that encompasses way too much to be put into a few words or statistics, but it’s important to understand just how interconnected each aspect of the financial industry is to this topic.

Below are just a few examples of open finance’s reach and the ripple effects that it has had on the market:

How Did Open Finance Get So Big?

Open Finance’s remarkable ascent is rooted in a complex narrative that intertwines decentralized finance (DeFi), the evolution of traditional financial systems, and a growing synergy with innovative technologies.

To understand how Open Finance became a prevailing force in the global financial landscape, one must journey back in time to 2012 when Vitalik Buterin, a Russian-Canadian programmer, conceived and co-founded the Ethereum (ETH) network.

Ethereum marked the inception of an open-source platform for building decentralized applications (DApps), setting the stage for what would eventually become Open Finance.

The Leading Role of DeFi In Open Finance’s Developments

DeFi, a financial operations protocol designed to decentralize financial services through peer-to-peer transactions and blockchain technology, predated the emergence of Open Banking.

However, Open Banking was not a natural evolution of DeFi, it emerged as a counter-trend to the DeFi wave. Initially, many experts attempted to dismiss the significance of DeFi. But as time progressed, established financial institutions began to recognize the potential of decentralized finance and its impact on the financial landscape.

Open Banking was conceived as a strategic response to the evolving DeFi ecosystem and its potential to disrupt the traditional financial sector. As DeFi gained momentum, discussions around market openness evolved into regulatory initiatives aimed at making financial services more flexible.

These measures aimed to reduce bureaucracy in the financial system and enhance regulatory flexibility to foster competitiveness. The result was the emergence of fintech companies, which represented a notable shift toward decentralization. These agile and specialized fintech firms quickly gained prominence and captured a share of the consumer market.

From Open Banking to Open Finance

This pivotal development led to the emergence of new financial players, the adoption of fintech principles by traditional institutions, the proliferation of virtual currencies, the rise of digital wallets, and the advent of instant payments. Regulatory advancements also further facilitated the expansion of non-traditional financial service providers.

The convergence of financial and retail sectors introduced tech giants like Amazon and Apple into the financial services arena. These influential players blurred the lines between traditional financial institutions and technology-driven entities, redefining the industry’s landscape.

The transformation from Open Banking to Open Finance marks a significant evolutionary step. Open Finance has superseded Open Banking, becoming a distinct entity within the financial services ecosystem. Open Finance’s development was intricately linked to Open Banking, and the two concepts are inextricably connected.

The journey from decentralized finance and fintech innovation to the emergence of Open Finance has been paved with detractors and friction, but some would say that its arrival was inevitable, due to its omnipresence in other countries. The question now is: Where does Open Finance find itself today?

What Is The Next Big Thing In Finance?

While Open Finance clearly shows dividends within the industry, the engine of change is still in full swing. No matter what new dish is available on the menu, the cooks in the back are constantly concocting new, innovative technologies that will undoubtedly have a major impact on the industry.

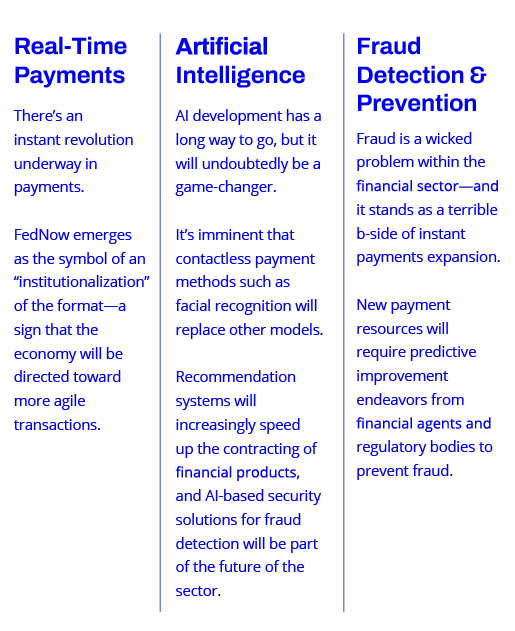

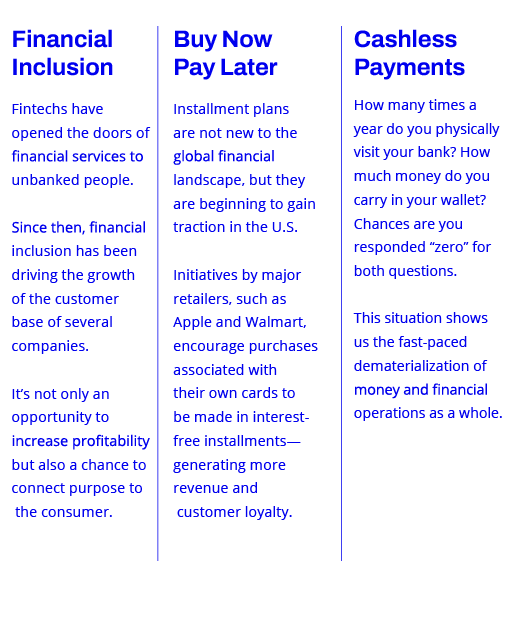

There are several driving forces within the financial sector, but these six are the ones we believe will have the most significant impact in the upcoming years:

What are the limits of Open Finance—and the future of the prevailing financial system?

As you saw in the previous topics, DeFi has significantly influenced the path the prevailing financial system took over the years.

And while this path looks straightforward, the only constant we can expect is change. There is no doubt that other concurrent advances will also shape the way we experience financial services today—and in the future.

While having a decentralized system for the sharing of financial information will undoubtedly bring about significant changes within the financial industry, it is not the meteor that will wipe out the dinosaurs within the financial sector.

In our Financial Trends Report for 2024, we carried out a forecasting exercise with three different scenarios about the future of financial services (and the system as a whole). To gain more insight into what the future might hold for FIs, click on the link below and register your interest in receiving the report scheduled for release on November 16th.

Change is never a simple transition, and the road that has been laid out for financial institutions comes with its own unique challenges and branching paths. In order for companies to be fully prepared for the trek, they need to be well informed, first and foremost.

The path ahead is winding and full of opportunities, and while walking it might not be a simple task, you don’t have to go it alone because MJV has got you covered. If you’re facing any challenges regarding changing your operations or building your own financial services solution, don’t hesitate to reach out to us.

Digital transformation is not a finish line, it’s a path—one that you don’t have to travel alone. Go far, with MJV Technology & Innovation.

Back